crypto tax calculator australia

Calculate your taxes in under 20. It has full integration with popular Australian exchanges.

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

The world of cryptocurrency and taxation is a murky one.

. You can discuss tax scenarios with your accountant. The percentage of Capital Gains Tax youll pay is the same as your personal Income Tax rate starting only from earnings above 18201. The Australian Tax year will be operating between 1st July 2021 - 30th June 2022.

Janes estimated capital gains tax on her crypto asset sale is 1625. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. It can be a difficult process to manually calculate the taxes accrued from your crypto transactions and the entire.

Heres an example of how to calculate the cost basis of your cryptocurrency. Youre viewed as a crypto trader by the ATO as its your main source of annual income. To lodge a tax return for the current tax year you will have to submit it before October 31st 2022.

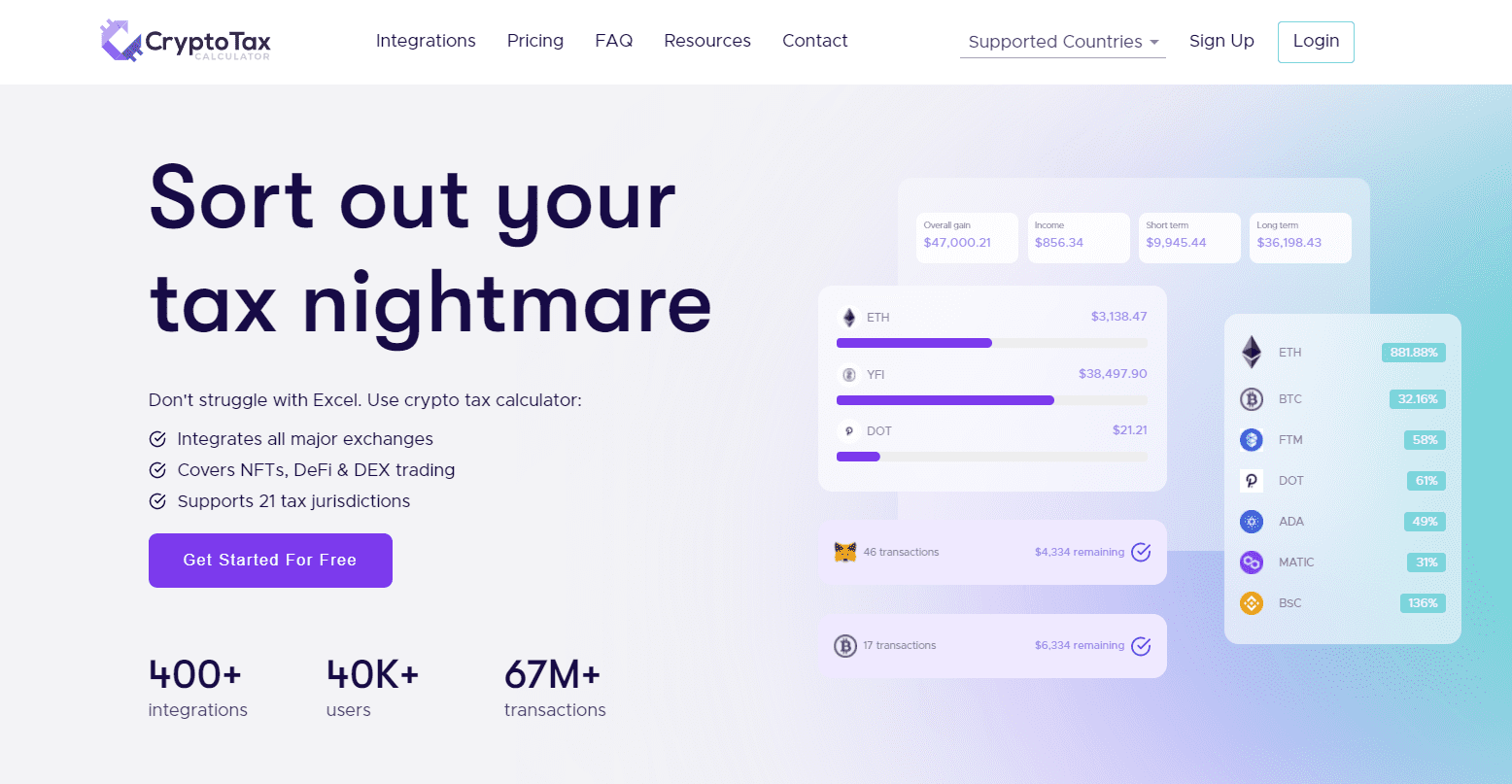

Our crypto tax calculator plans can cost less per year then a subscription to a streaming service. Were here to help you. How can Crypto Tax Calculator Australia help me with crypto taxes.

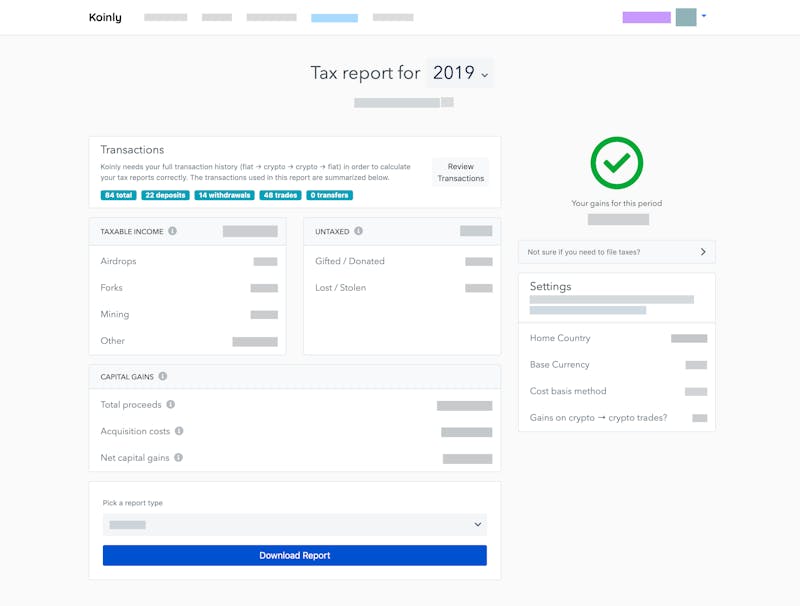

Koinly or Crypto Tax Calculator This report shows your profitloss and capital gains for the financial year. 0325 5000 1625. The resulting number is your cost basis 10000 1000 10.

Swyftx Evaluation 2022 Best Crypto Currency Exchange for Australia Market Tax Return Calculator 2022 Australia. The Australian Tax Office has sent out letters to thousands of crypto traders in the last few months. You can then send this to your accountant or tax agent.

Create a report on crypto activity using a crypto tax calculator like Crypto Tax Calculator Australia. Take the initial investment amount lets assume it is 1000. By now everyone has found out about cryptocurrency and you are most likely looking at buying.

Calculate your Crypto Taxes in Minutes Supports 300 exchanges ᐉ Coinbase Coinspot Coinjar ATO compliant. With Crypto Tax Calculator Australia it only takes minutes. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Swyftx is an Australian owned and operated crypto exchange that allows users to buy Bitcoin Ethereum and 320 other crypto assets.

Partnered with the largest tax preparation platform to make it easy for you to E-File your crypto gains and losses with your full tax return. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. View your taxes free.

These reports cant be easily manipulated and produce definitive results saving you or your accountant time and money. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. Download your completed IRS forms to file yourself send to your accountant or import into software like TurboTax and TaxAct.

Our tax reports are prepared by our crypto tax calculator application with complete accuracy based on your CSV files you upload. Australian citizens have to report their capital gains from cryptocurrencies. Ideally you should download a crypto tax report from your provider.

At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you have completed previously. You simply import all your transaction history and export your report. If you hold for a year youll pay 50 less capital gains tax on crypto gains.

Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly. Reporting your crypto tax activity. Send the report to your accountant to complete your taxes.

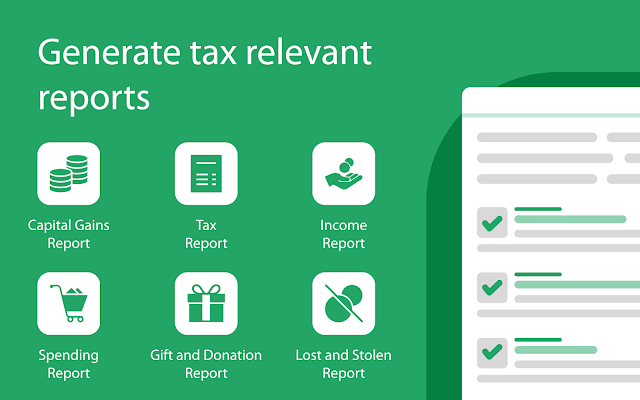

File your crypto taxes in Australia Learn how to calculate and file your taxes if you live in Australia. Capital gains tax report. You just need to import your transaction history and we will help you calculate your realised capital gains and current holdings.

In Australia youll pay Capital Gains Tax and Income Tax on your crypto investment. Welcome to the best crypto tax calculator application in Australia. Both categories will need to be updated with your relevant crypto values in your annual tax return.

Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes. A record of all crypto purchases sales and interest earned. 49 per tax season.

ATO Tax Reports in Under 10 mins. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. Here is a list of things you need before you lodge your crypto tax return with Etax.

If you are one of the unlucky ones then the task of getting your transaction history. Well go through the easiest and most accurate technique first. According to the estimates of the Australian Taxation Office ATO between 500000 and 1 million Aussies own cryptocurrencies.

Here are four strategies to successfully complete your crypto taxes. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Youll then pay 19 tax on the next 26799 of income and finally 325 tax on the final 5000 of income - or roughly 6717 in total.

The tax rate on this particular bracket is 325. Australias 2021 tax season begins on July 1st 2022 when reports are able to be submitted with the deadline for filing being October 31st 2022 or March 31st 2023 if filing via an accountant. Your first 18200 of income is tax free.

We use this to. Many crypto investors in Australia may soon face a hefty tax bill after a record-breaking year for cryptocurrencies in 2021. Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting.

You made 50000 throughout the 2021 - 2022 financial year. Accountant friendly tax reports. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Crypto Tax In Australia The Definitive 2021 2022 Guide

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Best Crypto Tax Software Top Solutions For 2022

Capital Gains Tax Calculator Ey Us

Best Cryptocurrency Calculator Mining Profit Taxes

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

25 Crypto Business Ideas That Will Make You Money Quick 2022

Cryptocurrency Tax Reports In Minutes Koinly

Crypto Tax In Australia The Definitive 2021 2022 Guide

Crypto Tax In Australia The Definitive 2021 2022 Guide

Crypto Tax Calculator Review Crypto Tax Tracking Software Australia Youtube

Crypto Tax In Australia The Definitive 2021 2022 Guide

Declare Your Bitcoin Cryptocurrency Taxes In Australia Ato Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Review Of 6 Crypto Tax Software Packages

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Cryptoreports Google Workspace Marketplace

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker